For home sellers, flood insurance naturally is crucial for legal compliance, financial protection, and property safety. Over 20% of US properties in high-risk areas lack coverage. Key steps include assessing flood risk using local maps, historical data, and professional inspections, then securing tailored policies from specialized insurers adhering to lender requirements. Regular policy reviews ensure ongoing protection against significant financial losses from flooding events.

In the face of ever-changing climate patterns and increasing global risks, understanding flood insurance has become paramount for sellers navigating the real estate market. The devastating impact of floods, a natural yet formidable force, necessitates a proactive approach to mitigate financial exposure. This comprehensive article delves into the intricacies of flood insurance, offering a clear guide for sellers to navigate this complex landscape. By exploring key aspects such as policy coverage, risk assessment, and available incentives, we empower sellers with knowledge, ensuring they make informed decisions and protect their investments in an uncertain world.

Understanding Flood Risk for Home Sellers

For home sellers, understanding flood risk is an essential part of the sales process, not just for legal compliance but also to ensure a smooth transaction and protect their interests. Flood insurance, naturally, plays a pivotal role in this context, as it offers financial protection against potential losses due to flooding. According to the National Flood Insurance Program (NFIP), over 20% of properties in high-risk areas don’t have flood insurance, leaving them vulnerable to significant financial strain post-disaster.

Assessing flood risk involves a multi-faceted approach. Sellers should begin by consulting local maps and data from the NFIP or similar authorities. These resources provide detailed information on designated flood zones, historical flooding events, and current risks. For instance, properties in low-lying areas near rivers, lakes, or coastal regions are statistically more prone to flooding. Additionally, sellers can engage professional inspectors who have expertise in identifying vulnerabilities specific to their property, such as inadequate drainage systems or nearby development that could impact water flow.

Once the flood risk is established, sellers must ensure compliance with local regulations regarding flood insurance. Typically, lenders require borrowers to purchase flood insurance on properties located in high-risk zones. This requirement, part of the National Flood Insurance Act, ensures that homeowners have financial protection against floods, which are often excluded from standard home insurance policies. For example, in areas prone to coastal storms or sudden flash floods, buyers and sellers must work together to ensure adequate coverage is in place before closing. Engaging with reputable insurance providers who specialize in flood insurance can offer tailored solutions, ensuring both parties’ peace of mind.

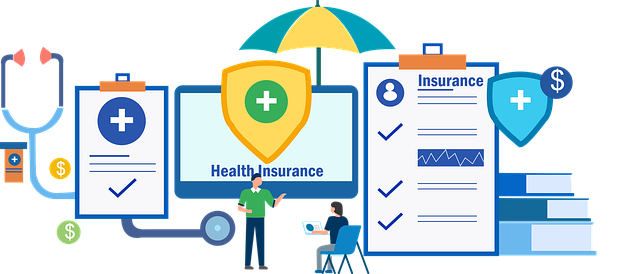

Why Flood Insurance is Essential for Protection

Flood insurance is an essential component of home ownership for any seller navigating the real estate market, particularly in regions prone to flooding. While it may seem like an additional financial burden, this type of insurance offers much-needed protection against one of nature’s most unpredictable and devastating forces. The importance of flood insurance lies in its ability to safeguard not only the physical structure of a property but also the financial stability of the borrower.

In many cases, standard homeowners insurance policies do not cover flooding, leaving sellers vulnerable to significant financial losses if their property is damaged or destroyed by a flood event. This is where flood insurance borrower requirements come into play. Lenders typically mandate flood insurance for borrowers in high-risk areas, ensuring that both the lender and borrower are protected. For instance, according to data from the National Flood Insurance Program (NFIP), over 20% of homeowners in the United States live in designated flood zones, emphasizing the widespread need for this specialized coverage. Without it, sellers risk being held responsible for substantial repairs or even the total loss of their investment if a flood occurs.

Moreover, flood insurance provides peace of mind by covering various expenses related to flooding, such as repair or replacement costs, relocation expenses, and legal fees. It is a proactive measure that allows sellers to focus on the future of their property rather than the potential financial pitfalls associated with unforeseen natural disasters. By understanding these flood insurance borrower requirements and recognizing its benefits, sellers can make informed decisions regarding their home protection strategy.

Evaluating Your Property's Flood Potential

When considering flood insurance for sellers, evaluating your property’s flood potential is a critical step. This process involves assessing various factors unique to your location and surroundings that contribute to flooding risks. It’s important to understand that every area has its own set of vulnerabilities; from proximity to bodies of water to topographical features and even climate patterns. For instance, properties near rivers or coastal areas are inherently more susceptible to flood events compared to those situated on higher ground.

Historical data plays a significant role in this assessment. Examining past flood occurrences in your region can provide valuable insights into the likelihood of future incidents. Many insurance providers maintain records of historical floods, enabling you to gauge the frequency and severity of these events over time. This information is crucial when determining appropriate coverage levels under flood insurance policies—a necessity for borrowers as per regulatory requirements. According to recent studies, areas with a 1% annual chance of flooding (often referred to as the 100-year flood plain) account for a substantial portion of total insured losses during significant weather events.

On-site inspections are another vital component. Professional assessors can meticulously scrutinize your property’s layout, construction quality, and surrounding environment. They look for indicators like inadequate drainage systems, low-lying areas prone to water accumulation, or even nearby development projects that could impact water flow patterns. These assessments help in identifying potential risks not immediately apparent to homeowners and inform decisions regarding specific flood insurance borrower requirements. By combining historical data, on-site inspections, and a comprehensive understanding of your region’s unique characteristics, sellers can make informed choices when securing flood insurance for their properties.

Navigating Flood Insurance Coverage Options

Navigating Flood Insurance Coverage Options is a crucial step for sellers preparing to list their properties. Understanding flood insurance goes beyond merely possessing coverage; it involves recognizing the nuances of various policy options available. Sellers must delve into these intricacies to ensure they’re adequately protected against potential losses, especially in areas prone to flooding.

Flood insurance policies can differ significantly in terms of scope and conditions. A key consideration is the 100-year floodplain map issued by the Federal Emergency Management Agency (FEMA). This map defines areas at risk of experiencing a certain level of flooding during a 100-year storm event. Homeowners or sellers in these zones often face stricter borrowing requirements from lenders, who mandate flood insurance as part of the loan package. These policies typically cover structural damage and belongings up to specific limits, but it’s essential to review the fine print for exclusions and limitations. For instance, standard policies might not cover losses caused by rapid rise in water levels, like flash floods, unless an add-on rider is purchased.

When evaluating options, sellers should assess their individual needs and property value. Higher-value homes or those located in higher-risk zones may require broader coverage than what’s offered through typical policy packages. Some lenders also mandate specific minimum coverage amounts, reflecting the borrower requirements. For example, a loan originating institution might demand $250,000 in flood insurance for properties situated in high-risk areas, ensuring adequate protection against potential catastrophic losses. Data from FEMA estimates that nearly 20% of properties in high-risk zones are uninsured or underinsured, highlighting the importance of proactive measures by sellers to safeguard their investments.

Experts suggest that sellers thoroughly review their policy options with reputable insurance providers and consider purchasing additional coverage for peace of mind. A comprehensive understanding of flood insurance borrower requirements and available coverage can help ensure a seamless selling process and provide adequate protection against potential flooding events.

The Application Process: Step-by-Step Guide

The process of obtaining flood insurance as a seller involves several crucial steps designed to ensure comprehensive protection for your property against potential water damage. Firstly, understanding your location’s flood risk is essential. Check with local and national meteorological services for historical data on flooding in your area. If your region is prone to floods, you’ll need to assess whether your property falls under the Standard Flood Hazard (SFH) zone defined by the Federal Emergency Management Agency (FEMA). This information is typically available through a simple online search or by consulting with a local real estate agent.

Once you’ve confirmed the flood risk, the next step is to contact an insurance provider offering flood coverage. Many major home insurance companies include flood insurance options as part of their packages. During the application process, prepare detailed documentation regarding your property and its history. This may include purchase records, renovation plans, and any previous claims or assessments related to flooding. Provide precise measurements and descriptions of structures and valuable items inside the property. The more comprehensive your application, the easier it becomes for insurers to accurately assess your flood insurance borrower requirements.

After submitting your application, the insurer will review your information and determine eligibility based on various factors such as location, building type, and construction materials. They’ll evaluate whether your property is located in a high-risk area and consider its susceptibility to flooding events. If approved, you’ll receive a quote outlining coverage details, deductibles, and premiums. Review the policy carefully, understanding what’s covered and any exclusions or limitations. It’s important to ensure that the flood insurance meets your borrower requirements and provides adequate protection for your investment. Regularly review and update your policy as needed to align with changes in your property or flood risk assessment.

Maximizing Benefits and Claims Handling Tips

Flood insurance is a crucial component of protecting your investment for real estate sellers, especially in areas prone to flooding. Maximizing the benefits of this coverage requires understanding both the policy details and efficient claims handling processes. This section provides essential insights to navigate these aspects successfully.

When selecting flood insurance, sellers should prioritize policies that offer comprehensive coverage tailored to their property’s specific risks. Flood insurance borrower requirements vary based on location and property type, so it’s vital to review these carefully. For instance, in high-risk zones, lenders often mandate specific minimum coverage limits and may require additional protections like flood barriers or retrofitting. Policyholders can maximize benefits by ensuring their coverage aligns with these requirements and adequately protects against potential losses.

Claims handling is another critical aspect of flood insurance management. Prompt reporting of flooding incidents is essential to ensure smooth reimbursement. Homeowners should familiarize themselves with the insurer’s claims process, including necessary documentation and communication protocols. According to recent data, timely filing can significantly accelerate claim settlements. Effective tips include documenting damage thoroughly with photos and videos, keeping records of expenses related to temporary housing or storage, and maintaining open lines of communication with insurance representatives throughout the process.

Regularly reviewing policy terms and staying informed about flood insurance borrower requirements is beneficial. Homeowners can ensure they remain protected as their circumstances change, especially when updating coverage for growing families or expanding properties. By following these guidelines, sellers can maximize the advantages of flood insurance and navigate claims handling with confidence, minimizing disruption during what could otherwise be a stressful experience.